From Richmond BizSense By Jack Jacobs

A local company that builds software for academic tutors has scored a sizable new batch of cash to help fill out its roster as it takes on new and larger clients.

Shockoe Bottom-based tech company Pearl, formerly known as Trilogy Mentors, recently wrapped up a $4.8 million capital raise, according to a recent SEC filing.

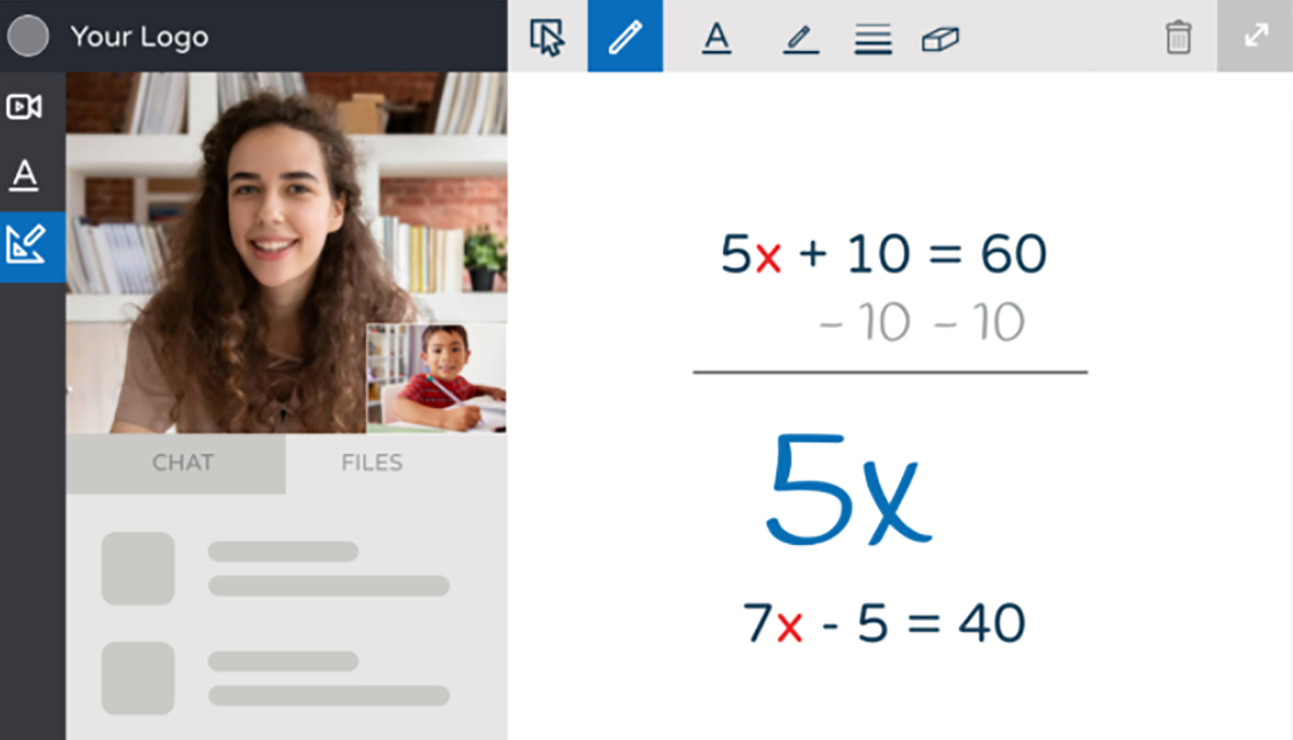

Pearl’s license-based software is used by tutoring companies, school districts and state college systems to run their own tutoring programs, whether online or virtual. The software features scheduling and reporting tools as well as virtual one-on-one and small-group classrooms.

CEO and founder John Failla said the company recently secured the second, $2 million half of the overall $4.8 million round and that newly acquired capital will be used to grow the company as it establishes itself as a software provider to large tutoring companies and state college systems.

“The second tranche is more focused on what we’re doing today with enterprise and state agencies,” Failla said. “People is the use here. We closed a lot of deals we have to make sure we can support.”

Pearl plans to use the funding to hire more employees such as designers and developers to further improve the software. The company currently has 14 full-time employees, two of whom were recently hired, and plans to add up to four more full-time by the end of the year, Failla said.

Pearl recently started to target large tutoring companies and government entities during a boom time for tutoring. The 2021 American Rescue Plan earmarked funds for tutoring to help address learning loss among students due to the pandemic.

“Overnight we went from working with tutoring companies that had five to 20 tutors in their business to now supporting states and enterprise tutoring organizations that were going after these massive state and district contracts,” Failla said.

The company inked a license deal in 2021 with a state college system that stood up a tutoring program in which college students tutor kids that attend in-state school districts. Failla declined to name the state.

Failla said Pearl added another college system to its client base this year and expects to add two more U.S. state agencies in the fall.

Blu Venture Investors in Vienna was the lead investor in the capital raise. New York-based Fidi Ventures also participated in the raise, as did CAV Angels, a group of UVA-affiliated angel investors, and 757 Angels in Hampton Roads, Failla said.

Pearl launched as Trilogy Mentors in 2015 and changed its name in 2021. The company originally would connect local tutors with local students but shifted to focus on licensed software development in 2019.

A company with up to 49 tutors pays a license fee of $40 a month plus $10 per additional tutor, according to Pearl’s website.

Failla said Pearl hasn’t achieved profitability yet.

The company is headquartered in the 1717 Innovation Center.